Bitcoin is literally taking over the global currency and traditional payment methods. So I’m not surprised if you’re here hunting for the best Bitcoin debit cards or top 5 Bitcoin debit cards comparison chart.

Bitcoin debit cards are a new addition to the whole Bitcoin community; they basically are either “Physical” or “Virtual” kind of debit cards which work and function just like any other debit card out there.

They can be connected to your Bitcoin wallet or other multiple cryptocurrency wallets and you can be used to spend funds from those accounts.

Why use a Bitcoin Debit Card?

Bitcoin still isn’t accepted “everywhere”. But with a Bitcoin debit card, you can make that happen. You can literally pay “anywhere” with a Bitcoin debit card.

Any merchant who accepts a “debit card” in general, can be paid through these cards. The funds would be deducted from your Bitcoin possessions, and the merchant would still get paid in his native currency.

Another major thing is you can directly spend your bitcoins and can buy anything from locally or globally without any boundaries. Another good reason for use bitcoins cards, you can save your lot of taxes because your all transaction are performed by Bitcoins, not from your bank accounts that’s why your government can’t regulate your funds.. and you can enjoy your life without any type government barriers.

How do the Best Bitcoin Debit Cards Work?

There are two primary types of cards, the Non-Flex (real-time cards) and the Pre-paid cards. Real-time Cards are like your standard ATM Debit cards.

They are linked to your Bitcoin Wallet, and at the time of use funds are transferred in real-time from your Bitcoin Wallet to the Card, and the purchase is made.

The Pre-Paid cards, as the name suggests however need to be pre-funded with the funds. These cards can be funded at any time you wish, these funds are then later used to make purchases.

In this case, you do not always need to link your Card to the wallet. Rather, simply sending funds from the Bitcoin wallet, to the card’s address is required.

The Best Bitcoin Debit Cards with Comparison Chart

So here are the best Bitcoin debit cards existing in the industry, we’ve selected the handful of them out of all the other options based on a number of factors, our personal experience, along with reviews and experiences of other users in the community.

If you want to know more about these charts then you can read these debit cards full description below.. And if you are you want to know where you can buy bitcoins easily by the help of Debit Card, Credit Card, Paypal or by Cash then you need to check below post links.

- Best Bitcoin wallet for computer/Web/Mobile

- How to buy Bitcoins with PayPal

- How to buy Bitcoins with Credit Card

- How to buy Bitcoins with Debit Card

- How to buy Bitcoins with Cash

- Best Trading platform for Bitcoin or Cryptocurrency Trade

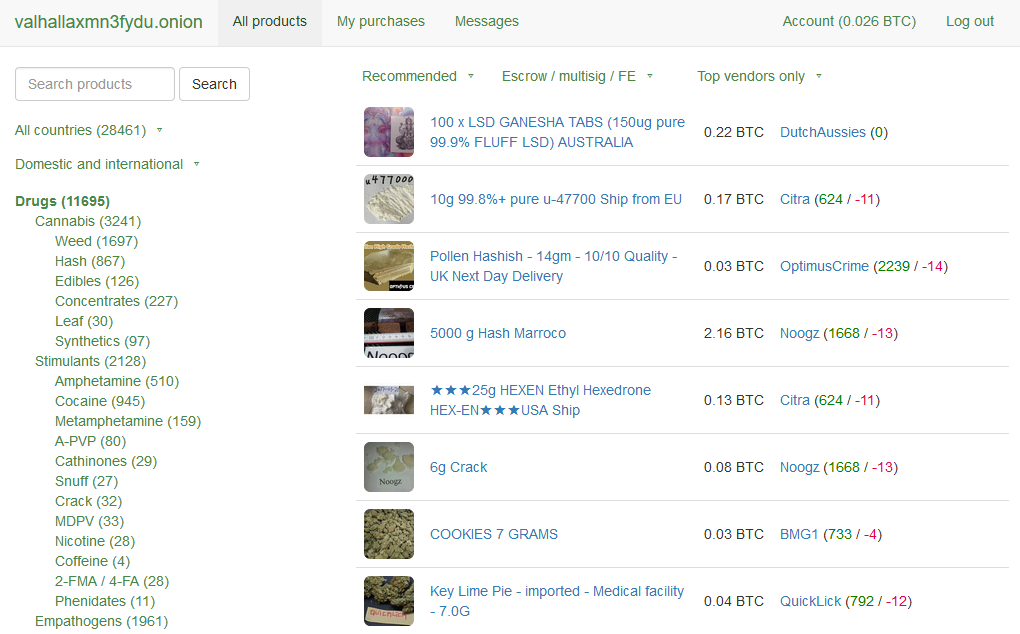

1. Binance Card

Website: https://www.binance.com/en/cards

Binance is without doubt one of our most favorite, and just the most secure and established Bitcoin exchanges on the planet. They also recently started offering their own VISA cards.

If you’re already a Binance user, you’re probably already level 2 verified. If not, that’s the level of verification (a govt. issued ID proof) required to obtain the Binance Card.

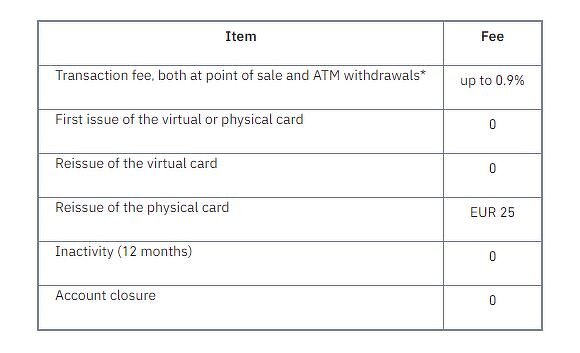

The fee is negligible and even non-existent in most cases. Here’s a more clear idea of how much it costs to use the Binance card:

You don’t even need to “top up” your wallet unlike most other Bitcoin debit cards in 2021. Funds can easily simply be converted from “spot wallet” to the “card wallet”.

That essentially means Binance Card isn’t just limited to BTC but can be used for almost all the Cryptocurrencies out there (when not possible directly, you can just exchange your currency to BTC/any other supported crytpo, can’t you?)

On top of all that, it also offers up to 8% cashback, the exact percentage depends on the amount of BNB in your account! The only downer for now is that it’s not globally available and has a specific list of counties where it’s available.

2. Coinbase

Website: https://card.coinbase.com/

We’re adding Coinbase as one of the best Bitcoin debit cards in 2022 after nearly 4 years of us publishing this piece originally. That’s because Coinbase didn’t have a debit card back then.

Coinbase is probably the most widely recognized, established and successful Bitcoin exchange (not a trading platform, but an exchange) on the planet. It’s even listed on NASDAQ!

Anyway, you can get the card absolutely free if you’re in the U.S. For people from Europe or U.K, the card costs EUR 4.95. All crypto spends cost 2.49%. ATM withdrawals are free.

It supports up to 9 different Cryptocurrencies. This means you aren’t limited to just Bitcoin but can also keep ETH, LTC and many other coins in your account.

It’s not anonymous. You must complete your KYC verification before getting the card.

Some of its best security features include 2-FA and the ability to freeze your card instantly.

It’s available instantly upon signing up, you can use it either as a virtual card, or wait till you get your physical card (about 5-7 days).

It has a spending limit of $2500/day and a ATM withdrawal limit of $1000.00 per day.

Do note that the card can be used to spend Bitcoins (or other crypto) anyplace that accepts VISA, with a few exceptions of course.

3. UQUID Bitcoin Debit Card

Website: https://www.uquid.com

The second contestant for the crown of the best Bitcoin debit cards is UQUID, having Cocsi ltd. as their parent company which dates back to the 2013s, although they entered the Bitcoin debit cards game only last year, that’s 2016.

The second contestant for the crown of the best Bitcoin debit cards is UQUID, having Cocsi ltd. as their parent company which dates back to the 2013s, although they entered the Bitcoin debit cards game only last year, that’s 2016.

Even though being fresh players in the game, they’ve learnt a lot from the already existing rivals and have tried to incorporate the positive features onto themselves.

a. UQUID Features

UQUID alike Cryptopay supports three major currencies, including:

- USD

- EURO

- Pound (GBP)

And Uquid too provides for both the types of Bitcoin debit cards, that’s the plastic as well as the virtual cards.

The cards can be used like any other debit card you might have from your local banks, in fact, you can also withdraw your Bitcoins instantly, in your native flat currency via as many as 34 million+ supported ATMs.

Also, QUID supports real-time withdrawals, meaning you do not have to keep your card loaded, instead they get loaded and withdrawn to your point of withdrawal in real-time exactly when you need the money. (This helps you get real-time conversion rates).

b. Fee

UQUID Plastic cards can be purchased for $16.99 (which is comparatively more expensive than the CryptoPay cards), while its virtual cards cost just $1.

In addition to that, a monthly service fee of $1 is levied as well on both the Plastic and the Virtual cards.

UQUID too offers two kinds of shipping, the standard shipping which takes around 14 days globally, or you can go for their expedited shipping at an additional cost of $35 in which case you’ll get your cards in less than a week.

Domestic transactions cost $2.50/transaction, while the fee for international ATM transactions is $3.00

Checking of card balance or any other information related to the cards isn’t charged and is free.

Bitcoins can be deposited free of cost, while bank transfers are charged at 1.5% of each deposit. The highest being paysafecard at 18%.

The Withdrawal can only be done to your bank, and a fee of 3% of the transaction is charged on each withdrawal.

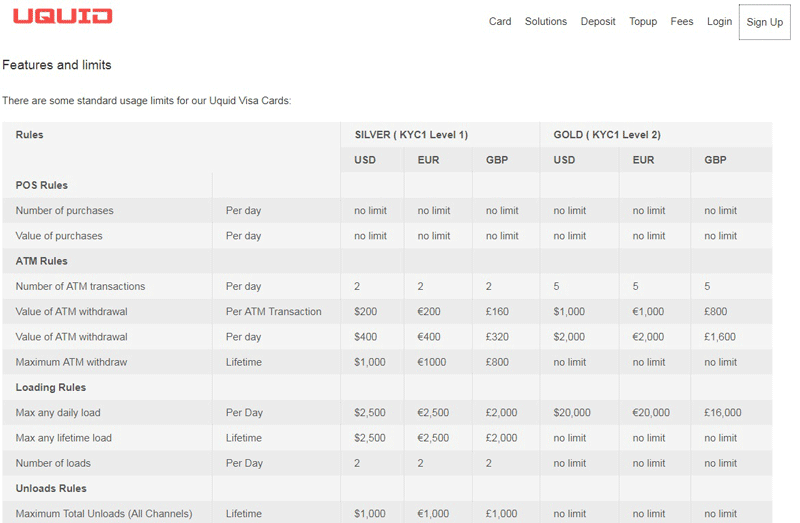

c. Limitations

As of now, UQUID supports as many as 174 countries in total, but then again it also “doesn’t support” some, and the unsupported countries are:

- USA

- India

- Zimbabwe

- Yemen

- And around 50 other countries from the middle-east. The full list can be found here.

Also, only one card/email is allowed on UQUID (not that it’s a deal-breaker cause you can always create a new E-mail and order another one).

Another limitation on UQUID is that bank-transfers are possible only if you’re a verified UQUID user, if you wish to remain anonymous without any verification, you’ll have to use an alternate method to deposit funds to your cards, such as Bitcoin or any of the other 40 supported altcoins.

Their Unverified membership (Silver Package) let’s you withdraw upto the amount of $1000 USD lifetime, with a per transaction limit of $200 and daily limit of $400. These can be topped up to a maximum limit of $2500 USD.

While, the Gold members (KYC verified) can withdraw $2000/day, with $1000 being the per transaction limit, and no lifetime limit being imposed.

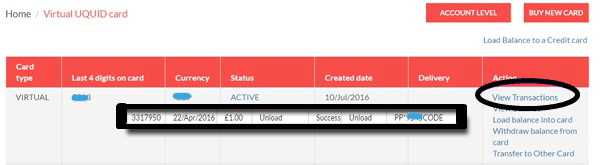

d. User-Experience

A major part of how we define and select the best Bitcoin debit cards is User-Experience. Although we must admit UQUID could use some improvements on this front.

Their dashboard is simple-enough no doubt, It’s basically divided into a top bar, which consist of :

- Account Level

- Buy new card.

The centre-screen consists of a table which gets you data related to your card, such as:

- Card type

- Currency

- Status

- Last 4 digits of your card.

- Created

- And some other information.

And the right-sidebar of the centre-screen is what helps you perform the major actions, such as:

- View transactions

- Load balance.

- Withdraw

- Transfer etc.

The only problem? Their English isn’t English. Meaning, you might find the page to be similar to “Google Translator’s” version of the page, with quite a few grammatical and punctuation mistakes.

But apart from that, yeah the other features totally have earned their place on this list of the best Bitcoin debit cards.

e. UQUID Pros and Cons

Pros:

- Supports real-time transactions.

- Virtual cards are available.

- Supports 3 currencies.

Cons:

- Doesn’t support USA, India and some other countries.

- Limited features for non-verified users.

4. BitPay Debit Cards

Website: https://www.bitpay.com

BitPay is another great option and alternative for those hunting for the best Bitcoin debit cards. Being honest, we didn’t give BitPay enough attention earlier, but now we regret not doing so.

And considering how BitPay isn’t a new name in the Bitcoin community and have been serving us for the last 6 years, only the best of the services can be expected from their debit cards as well, let’s see how far the claims hold to be true.

a. BitPay Features

BitPay cards are again VISA cards, which means they can be used at every single POS (point of sale) which accepts a VISA debit card, even internationally.

The primary point of difference between Bitpay and the other cards on this list are:

- BitPay supports only USD for now.

- BitPay is also available in the United states! (And that too, for both US as well as Non-US citizens!)

In fact, it’s the first Bitcoin debit card which supports and is available in all 50 states of the United States.

As per their 2016 report, BitPay has already issued over 15,000 cards (which might be a much higher number by now) and also they reportedly have over 20,000+ people on their waiting list.

Also, Bitpay is a Plastic only debit card, meaning it doesn’t provide for virtual debit cards.

b. Fee

The BitPay Bitcoin debit cards are available at a price of $9.99 which makes it one of the cheapest cards on this list of the best Bitcoin debit cards.

They also offer expedited shipping at an additional cost of $60.00

ATM withdrawals are priced at $2.00/transaction, while the charge for ACH transfers(debits) is $5.00/transaction.

The good news is, they’ve included a way to avoid these extra charges on their official fee documentation.

There’s an additional fee of 3% for non-US transactions. The same applies for non-US ATM withdrawals as well.

c. Limitations

The primary limitation that the BitPay card has is that it’s a “plastic only” card, meaning it’s not available in the virtual format.

Also, it’s an USD only card, so unlike Cryptopay or UQUID which supports 3 currencies, BitPay does only one.

There’s a purchase limit of $10,000/day, cash withdrawal limit of $3000/day, the load limit being $10,000/day while letting you hold as much as $25,000 at any given point of time.

There’s also a $5.00 dormancy fee, which is levied if the card is left unused for 90 days in a row.

Also, it’s mandatory for you to verify your identity in order to use BitPay Bitcoin debit cards, so there are no unverified accounts.

But the verification process requires simply your Social security number and not any other kind of documents as is the case with most of the other cards on this list of the best Bitcoin debit cards.

Apart from all that, it’s also a prepaid Bitcoin debit card, meaning it doesn’t have “real-time” transactions such as UQUID, instead needs to be topped up with Bitcoin balance, which is then converted to USD and stored in the card and only then can it be spent.

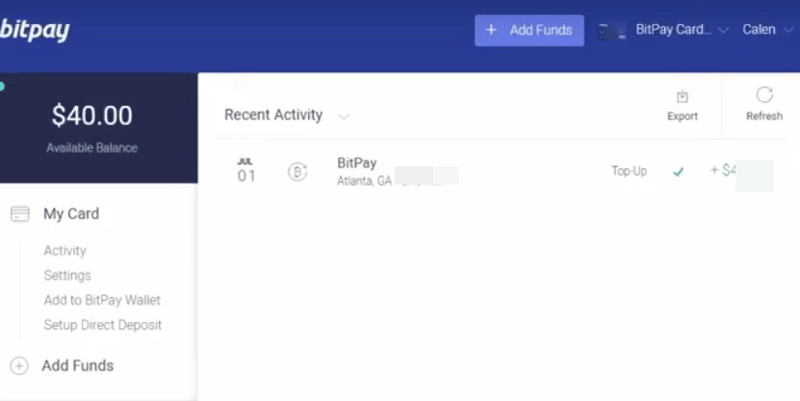

d. User-Experience

As far as the user-experience goes, BitPay certainly knows how to make you feel at home. Here’s how the BitPay dashboard looks like:

The top-left corner shows you your balance, then there’s the left-sidebar with all the navigation options such as :

- Activity

- Settings

- Add to BitPay wallet

- Setup direct deposit.

These are simple links which let you navigate to the different sections of the platform.

The center-screen holds your transaction history. Simple as that. Obviously, this is the level of simplicity that was expected from a company with the repute that BitPay holds so we’re satisfied on a personal level.

e. BitPay Pros and Cons

Pros:

- Available in all 50 states of the United States.

- Reasonable fee.

Cons:

- Only USD is supported as a currency.

- No Anonymity.

- It’s a Prepaid card, so conversion rates might be slightly different than industry prices.

- No Virtual cards available.

5. Xapo Bitcoin Debit Card

Website: https://www.xapo.com

Xapo is yet another option you can explore when tracing the footsteps to the best Bitcoin debit cards. It’s one of the most reputed companies in the industry, and has made a name for itself even in the debit cards’ game.

It might not be the absolutely best Bitcoin debit card out there, but it certainly has the potential to be one of them.

The primary reason we’re claiming so is because it supports nearly ALL the countries on the globe, yes even including the United States and India.

a. Xapo Features

Xapo similar to BitPay is a Plastic only debit card, and isn’t available as a virtual card. Also, the primary feature separating it from CryptoPay is that it’s an automated (non-flex) Bitcoin debit card.

Meaning, it’s connected to your Bitcoin wallet, and when you make a purchase, the amount worth your purchase is pulled from your Bitcoin wallet automatically and is spent.

The problem with this is that, Xapo always uses its own exchange to convert the funds from your Bitcoin wallet to flat currency, so the exchange rates aren’t always favourable.

Although on the plus side, it provides for an easier user experience, simply swipe your card without the need to load funds manually and you’re done.

Xapo too supports 3 currencies, similar to most cards on the run for the best Bitcoin wallets crown, which are USD, GBP and EURO.

b. Fee

The Xapo Bitcoin debit cards can be ordered for:

- 20 USD

- 18 EUR

- 13 GBP

It takes anywhere between 15-20 days for the Xapo card to reach you from the day of placing the order.

There are no monthly charges, although there’s an yearly fee, which is 12 USD, 7 GBP, 10 EURO respectively, although this fee is waived off for the first year.

Spending coins in the native currency of the coin is free, but foreign currency exchange (purchase) is priced at 3% of the transaction.

ATM Withdrawal isn’t free either and is charged at $2.50/transaction, while international ATM withdrawals cost $3.50

It’s worth noting that you pay dual fee in case you withdraw cash internationally, as they charge both the ATM withdrawal fee ($3.50) + the foreign exchange fee of 3%.

c. Limitations

If you’re hunting for “anonymity”, we would advise you to choose from one of the other available options from this list, because Xapo is completely KYC compliant, and offers only verified services.

Infact they’ve clearly stated that “Xapo is not an anonymous service”, so yeah that’s one of biggest contrasts of having a Bitcoin debit card which is against anonymity, which is to be used to spend Bitcoins which is primarily pillared upon providing anonymity.

As far as ATM withdrawals go, users are limited to 2 transactions /day, 14 /week and 56/month. The maximum amount of $1000 can be withdrawn in a single-go, and the daily limit is $2000/day.

The per purchase spending amount is $10,000 so you can’t spend an amount exceeding this number for a single purchase, and the maximum limit of spending money/day is $20,000.

There also is a depositing fee of 1% /deposit.

Although most of these spending and withdrawal limits can be withdrawn if you prove your identity by uploading a govt. issued ID card and a proof of residence.

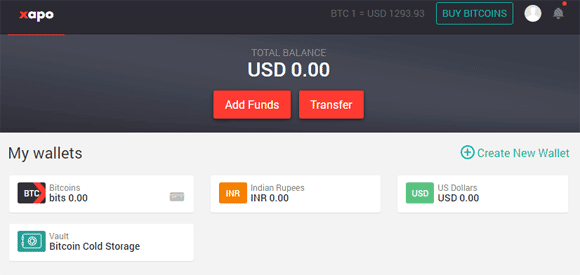

d. User-Experience

The User Experience with Xapo is great as well, the page lists out 4 default wallets for your account:

- Bitcoin wallet.

- USD Wallet.

- Your native currency wallet (According to your country of residence).

- Bitcoin cold storage.

There’s a bold enough “Add Funds” button on the center-screen, accompanied by a transfer button right next to it.

Account settings can be accessed from top-right corner of the screen like most other user-oriented profiles on the planet.

Bottomline, it’s pretty easy and well-made.

e. Xapo Pros and Cons

Pros:

- Supports countries like USA and India.

- Good security measures and 2-factor authentications available.

Cons:

- No Anonymity.

- No virtual cards available.

- Deposit fee of 1%.

6. SpectroCoin Bitcoin Debit Card

Website: https://www.spectrocoin.com

SpectroCoin as a company has garnered for itself quite the share of negative reviews in its initial days, but maybe that’s simply because they were new to the game and were setting themselves up.

Anyway, we wouldn’t advise or redirect you to them saying they are the best Bitcoin debit cards, instead from our perspective they should literally be the last resort if for some reasons nothing else on this list seems to be working for you.

a. SpectroCoin Features

SpectroCoin supports the three traditional currencies like any other Bitcoin debit card, which are USD, GBP and EUR.

Shipping generally takes a 1-4 weeks time depending on your location, and they offer expedited shipping as well for additional charges.

SpectroCoin too, similar to Xapo is a non-Flex debit card. Meaning it doesn’t allow or support the manual deposit-spending process, instead it’s connected to your SpectroCoin wallet and exchange.

The one edge SpectroCoin seems to offer us is that it provides for unverified accounts as well, so verification isn’t mandatory and some level of anonymity can be expected.

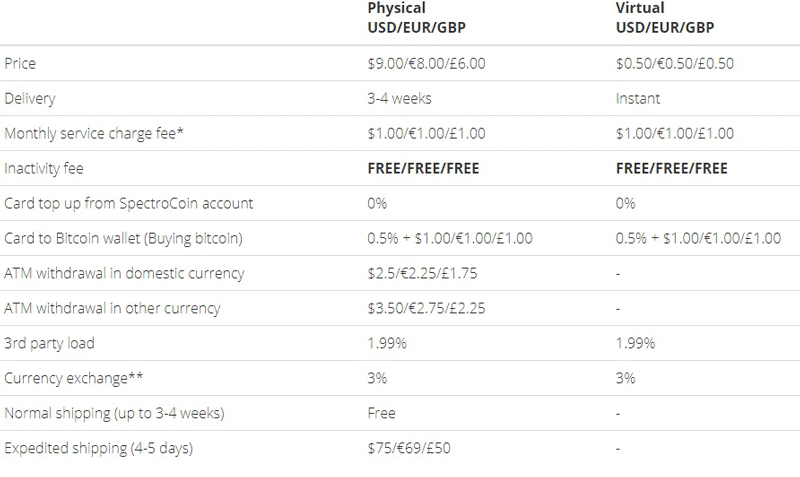

b. Fee

The cards cost 9.00USD, 6.00GBP and 8.00EUR respectively. The cards are available both in virtual, as well as physical plastic formats, and the virtual cards are comparatively cheaper than other cards on this list of the best Bitcoin debit card wallets, and cost just $0.50 (the amount is the same for all three currencies).

There’s a monthly service fee of $1.00 (same amount for GBP and EUR as well) for both the kinds of cards.

ATM withdrawal is charged at $2.5 or 1.75 EURO/domestic transaction, while other currency withdrawals or transactions are charged at $3.50 or 2.25 EURO.

They also offer expedited shipping as we mentioned in the earlier section, at the price of an additional $75/€69/£50 and you get your cards at your doorsteps in less than a week.

Note that there is no “inactivity fee” (dormancy fee) which is quite convenient.

c. Limitations

As we mentioned earlier, not much verification is required with SpectroCoin so it’s not as exposed as Xapo.

Also, it supports nearly all the countries out there, again including USA and India, the two countries not many cards on this list of the best Bitcoin debit cards list have shown their appreciation for.

You’re allowed to top up your cards for a maximum of 2 times/day, where unverified users can top up upto $2500, and verified users are granted liberty upto $20,000.

Unverified users are also restricted at a max lifetime load of $2500, while it’s unlimited for verified users.

Unverified users can withdraw a maximum of $200 at a time at any ATM, and the daily limit of withdrawals for them is $400.

While for verified users, the single withdrawal limit if $1000 and the daily limit being $2000/day.

Unverified users are also restricted at a total lifetime unload from the card of $1000, and this limit is again waived off for verified users.

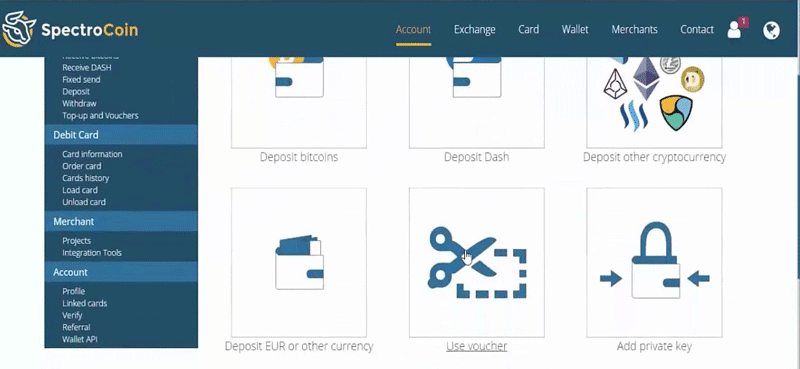

d. User-Experience

The dashboard at SpectroCoin is truly one of the best dashboards on this whole list of the best Bitcoin debit cards.

It’s somewhat of the “Metro” layout, with the primary links being situated at the left-sidebar, the center-screen offering options such as Deposit cash, withdraw and everything else.

The top bar holds the following options:

- Account

- Exchange

- Card

- Wallet

- Merchant

- Contact

Bottomline, it’s well designed with good, illustrative icons so that makes it one of the easiest Bitcoin debit card wallet dashboards.

e. SpectroCoin Pros and Cons

Pros:

- Supports Majority of countries including USA and India.

- No dormancy fee.

- Nearly unlimited access and features for verified users.

- Anonymous

Cons:

- Some negative reviews and user experiences in its early days which it still has to clean-off.

- Non-Flex card (no manual deposits, it’s linked to SpectroCoin wallet).

7. Plutus

Website: https://plutus.it/

Plutus is a comparatively newer player in the industry but is exceedingly impressive. Let’s get right to it then?

a. Plutus features

For starters, Plutus is a non-custodial Bitcoin debit card. Meaning, the company at no time has access to your private keys. In simpler words, only you have access to your Crypto.

Then, it’s available in more than two dozen countries. The list includes:

Austria, Belgium, Bulgaria, Cyprus, Czech Republic, Croatia, Denmark, Finland, France, Greece, Germany, Hungary, Iceland, Italy, Ireland, Liechtenstein. Lithuania, Latvia. Luxembourg, Malta, Netherlands, Poland, Portugal, Romania, Slovakia, Spain, Slovenia, Sweden, and United Kingdom.

It does require KYC and it’s mandatory. Note that identification from all countries are accepted, regardless of your original nationality. As long as you reside in one of the supported countries.

Additionally you can manually recharge your card (without having to link it with some wallet.

It also has its own exchange. It can be used to redeem rewards, load balance onto the card, trade Cryptocurrencies or buy/sell PLU (Plutus Cryptocurrency).

b. Plutus fee

Plutus uses a “per month subscription-based model”. Your fee, limits, and other benefits depend on your subscription plan.

The Starter plan is free. The card costs €9.99 one-time if you go with the starter plan. This plan also has a 1.75% trading fee should you choose to trade using the card. It also doesn’t offer any cashbacks or rewards.

The “Premium” plan costs €4.99/month. The card is free of charge on this plan. Trading too is free. In addition to this, it also includes 3% rewards in PLU for using the card.

PLU can either be exchanged for a month of free premium service (costs 1PLU), or can be converted to fiat/ other Crypto funds.

Finally, the “Pro” plan is priced at €7.99/month. It offers higher limits (discussed in the next section) than the “Premium” plan.

Withdrawals are free on the Pro plan. They cost €3.50/withdrawal on the premium plan and €5.50/withdrawal on the free plan.

Fortunately, normal transactions (at shops/malls or anywhere else) aren’t priced depending on your plan. So, the fee is the same for every plan. The per-transaction fee does differ based on your location. However, it costs around €0.57-€1.00 with an additional 1% (depending on the location) per transaction.

ATM withdrawals are charged between €1.35-€1.75/withdrawal (depending on the location.)

c. Plutus limitations

Being one of the best Bitcoin debit cards doesn’t mean it’ll be without limits. So, the cards are allowed to have a maximum balance of €7500.00

The daily/weekly and monthly spend limits are €2500.00, €3000.00, and €5000.00 respectively on the starter (free) plan. These can be increased by going for one of the paid plans.

The daily ATM limit is €300.00 on all plans. A weekly €500.00 and monthly €1000.00 ATM withdrawal limit exist as well.

There’s also online transaction (E-commerce) limit on the cards. It starts at €2200.00/day on the free plan. However, it’s extended to €5200.00/day pro and €7200.00 on the premium plan.

The weekly and monthly limits vary depending on your subscription plans as well.

e. Plutus Pros and Cons

Pros:

- Direct card recharge/topup.

- Integrated exchange.

- 3% cashback on transaction.

Cons:

- Only ETH and PLU supported for now. (Bitcoin soon-to-be integrated.)

- Mandatory KYC.

CryptoPay Bitcoin Debit Card

Website: https://www.cryptopay.com

Cryptopay is the first name that would popup on anyone’s radar who has been connected to, or interested in the Bitcoin debit card upheaval recently.

The primary reason probably being that Cryptopay isn’t a new player on the ground, but instead has been here for the last 4 years, that means it was founded back in the 2013s which clearly indicates they know what they’re doing.

a. CryptoPay Features

You can order Bitcoin debit cards from Cryptopay both in Virtual, as well as a physical form which consists of chips and Pins.

Cryptopay Bitcoin debit cards are “VISA” debit cards which can be used globally, in any country without any national restrictions.

The process of sending (topping up) money to your Bitcoin account on Cryptopay is pretty easy as well, and isn’t in any way different or complicated as compared to getting a normal bank transfer done.

b. Fee

There are two ways to receive the ordered cards, “Standard” and “Express”; Standard delivery takes longer but doesn’t consist of any additional fee, while the Express delivery requires an additional amount of $75.00, but gets you the cards in not more than 10 days in nearly any country across the globe.

The fee on both the types of cards differ greatly, the plastic cards are priced at $15 (the price is the same for USD / EUR or GBP), while the virtual cards, as they do not have any printing or plastic cost, can be obtained for as low as $2.50

Domestic ATM transactions are charged at $2.50, and internationals are priced at $3.50. There also is a monthly service fee of $1.00 (it’s the same for any currency).

There also is a loading fee of 1% each time you load your card.

c. Limitations

The unverified cards can be used 2 times/day for ATM withdrawals, while the verified cards can be used 5 times/day.

The total amount of ATM withdrawal for the unverified debit cards is $400, while for the Verified cards it’s $2000.

Although, third party loading of the card is unavailable on the unverified cards, and is possible only if you own a verified card.

It’s worth noting that Cryptopay even though offers its services throughout the globe, has excluded some countries and doesn’t provide debit cards to the same. The excluded countries are:

Map: The countries in Blue are the ones where the cards can be issued and delivered to, the countries in Grey are the countries where the cards aren’t available at the moment (10th September, 2017).

- United States

- India

- Algeria

- And some other countries according to the map.

d. User-Experience

As far as the user-interface goes, the welcome dashboard is pretty well organized. The screen is divided into two simple parts, the top-bar, and the center-screen.

The Top bar consist of the following options:

- Accounts

- Transfers

- Send

- Referrals

- Account Information

The center-screen holds all your Bitcoin accounts for different currencies. So basically, even on your first-day with Cryptopay you won’t be hunting and fishing for options, it’s all right there on the welcome screen.

Cryptopay really makes it easy to store different kinds of currencies in the same account as you get 3 different wallet addresses by default!

The verification process for the account is pretty easy as well, you can use any govt. issues ID card such as:

- TAX Documents.

- Bank statements.

- Electricity / Utility bill

- Or any other proof of residency issued by the govt.

So here’s an overall wrap up of the Cyptopay debit cards

e. CryptoPay Pros and Cons

Pros:

- 3 flat currencies supported.

- Supports unverified accounts.

Cons:

- KYC Mendatory

- Bed Support.

- Doesn’t ship to India, USA, and some other countries.

How do I get Bitcoin Debit Cards?

Most Bitcoin Debit cards as explained above are plastic cards. In which case they’re sent via physical mail. Companies have their own shipping policies, some use Standard shipping while others allow Express and other modes of shipping.

For “Virtual Cards”, no physical shipment is required. The details for the card (Number/ Expiry Date/ CVV etc). are sent over digitally (Via E-mail, or via the user dashboard).

Final Verdict:

So that’s all I can pour out for this piece on the best Bitcoin debit cards folks, if you ask us for one absolute answer, it probably would be CryptoPay.

But then again, most other Bitcoin debit cards on this list possess nearly the same features with just slight differences.

So in order to actually decide which card is the best, the most practical approach is to get one of these, and compare it with your friends or others in the communities who might have other cards.

Do let me know your verdict on the best Bitcoin debit card, and also your experience on this piece.